January 8, 2024

The Central Bank of Belize announces updates on electronic funds transfer (EFT) and instant funds transfer (IFT) transaction charges by domestic banks.

In its press release of 3 January 2024, the Central Bank informed the public that the Belize Bank Limited was granted an interim injunction on the enforcement of Practice Direction No. 7 – Regulation of Fees and Charges (PD No. 7), until the hearing and determination of its application for permission to apply for judicial review and an interim injunction. This injunction prevents the Central Bank from implementing PD No. 7 until the court has made its determination with respect to the said applications.

At the same time, separate from the obligations of PD No. 7, the Central Bank had indicated its elimination of charges on EFTs and IFTs processed through the Automated Payment and Securities Settlement System to further stimulate online transactions, with effect from 2 January 2024. The Central Bank’s elimination of charges prompted domestic banks to reduce the EFT/IFT fees, which domestic banks charge to their customers, effective 3 January 2024.

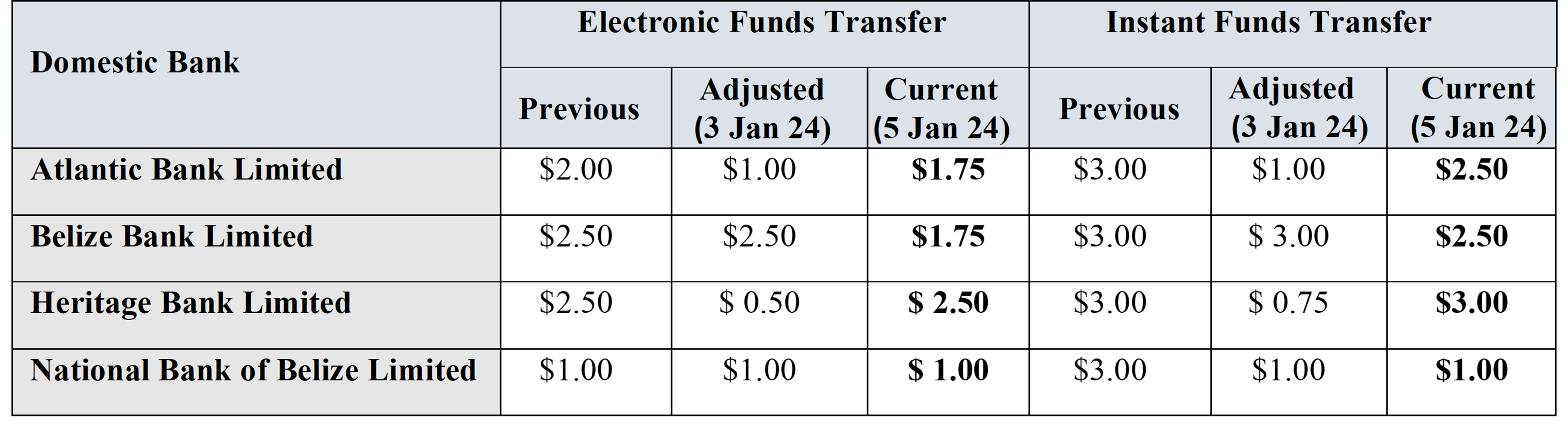

The Central Bank notifies the public that, except for the National Bank of Belize Limited, domestic banks have readjusted their online transaction fees effective 5 January 2024. The current charges are as follows:

The Central Bank recognizes the importance of transparent and fair banking practices and is committed to keeping the Belizean public informed about changes in the financial landscape. The Central Bank encourages customers to review their transaction statements and reach out to their respective banks for further clarification on the revised rates.